|

Bill's Blog - 2015

May 6, 2015 As I said in my recent newsletter, several small cap names in Peattie Capital portfolios have been extremely volatile, most notably KVH Industries ("KVHI"), which has dropped ~20% from its nearby high of $15.65 less than a month ago. There have been several other 25% drops in the shares over the past few years as it is thinly traded (~30,000 shares daily) and there are several institutions who own well over 1mm shares of the approximately 15mm shares outstanding. I reiterate that while this short-term volatility is stressful, my belief is that KVHI will be successful and patience will be rewarded. The company reports on May 7, and the annual meeting of shareholders is May 27, where I will get the chance to speak with several executives directly. I am adding shares of KVHI at the current $12.70, which I think represents a wonderful buying opportunity, although I expect that volatility will continue as the company grows. My two other largest positions are Sealed Air ("SEE") and Macquarie Infrastructure Trust ("MIC") and each bounced ~4% the day they reported, despite doing so on days when the markets were down over 1%.

Bill's Blog - 2014

January 14, 2014 For me, there are two noticeable events so far this year: 1. Unlike both 2012 and 2013, the first few days of the year in equities have been choppy and volatile. As far as I'm concerned, this is a welcome turn of events, as I have written in several recent newsletters that sentiment is overheated and a correction is long overdue. In addition, January is a tricky month, with rebalancing and reallocating creating distortions. I repeat that, on balance, while conditions for equities remain good, stock picking will play a more important role in generating returns this year than in 2013. 2. I've been following economic reports since I joined Credit Suisse's (then called First Boston) fixed income trading department in 1985. My response to the surprisingly weak jobs number last Friday (+74,000 against expectations of +200,000) is twofold: A) the weather played an extraordinarily large part in it, and subsequently we will see significantly higher revisions (this happens with surprising frequency) and B) structurally, the labor force is shrinking as a result of baby boomers beginning to retire. According to David Rosenberg (Breakfast with Dave Jan 13, 2014), 1.5mm baby boomers are expected to retire annually for the next 15 years.

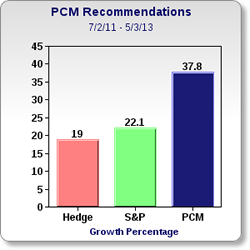

Bill's Blog - 2013 December 12, 2013 Sentiment flashing yellow�. I like the investors intelligence poll because it has a long track record and has been particularly useful at extremes (in either direction). I cited the 42.8 spread in the December newsletter as it is as high a level as we've had all year, and that I would be watching closely. The latest report is even more extreme, with a "bullish" share of 58.2% (highest level in 2013) while the "bearish" share remains mired at 14.3%. So the spread has widened to 43.9. There are a multitude of good reasons for such optimism, and I continue to believe that the overall conditions for equities looking out say, 6-24 months are very, very good. But in the near term, odds favor a correction, which would be healthy, based on what I believe today. November 11, 2013 How Sidelined Investors Can Get Back In The Game I was recently interviewed by John Spence about my outlook for the markets and why investors remain on the sidelines despite this big rally. The interview was picked up at TheStreet.com. I think potential investors are still shell shocked by the big corrections since the spring of 2000, and in addition don't trust Wall St�. Several consecutive years of government shutdowns have also contributed to their fear and skepticism. It makes sense though to at least get started with a portion of your investable assets, as the environment is still good for equities generally and plenty of opportunities for stock pickers. Here's a link to the full article. October 28, 2013 This is no time to get off the equity train One of my favorite financial journalists, John Authers from the Financial Times, has an excellent piece in this weekend�s FT, �This is no time to get off the equity train.� At the risk of oversimplifying, it provides a neat overview of the proliferation of David Swenson�s alternative approach, adopted in the 1980�s, which broadened away from a basic stocks/bonds/cash approach into a variety of alternative assets such as hedge funds, private equity, and real assets such as timber. At the time, doing so made perfect sense, but recently this approach has been much less effective. In the 2011-2012 period, for example, Yale made 4.7%, the S&P 500 made 5.5%, and a simple 60/40 (stocks/bonds) portfolio, which is the way it was done before Swenson�s approach, would have risen 6.3%. Authers also points out how useless diversification has been the past five years, and indirectly supports one of Peattie Capital�s core beliefs, which is that diversification is least effective in sharply moving down markets. In other words, it is at its worst when you need it most. While market conditions are always changing, one effective approach is to look for mispriced assets, which is exactly what Peattie Capital strives to do for its clients. At the other extreme, and not to say that this approach is always right either, but I recently heard a story about a highly successful investor who passed away�.when his family opened his IRA, which was worth well in excess of $10mm, it consisted of only two stocks. September 27, 2013 What a great month September has been�. Early in the month the trial involving Gulf Keystone ended with all charges being dismissed. The shares responded by bouncing 20% to $3.50, although they have backed off a bit since. Then Mako Surgical (�MAKO�), one of Peattie Capital's recommended stocks, received a takeover bid from Stryker (�SYK") for $30 per share, nearly double the preceding close of $16.17. This is the third core holding in most Peattie Capital portfolios to be bought this year, the others being Telular (�WRLS�) bought by a private equity company, and Heinz (�HNZ�), which was bought by Warren Buffett. While I�m delighted to enjoy the windfalls they have provided, a part of me is disappointed they are no longer around as I believe they would�ve provided even better returns over the long term. Meanwhile a number of core positions have had strong months such as KVH Industries (�KVHI�), Carters (�CRI�) and Seagate (�STX�). September has been one of Peattie Capital�s best months ever. May 10, 2013 "Tips from Wall Street hedge fund gurus fail to reward the faithful"

The article states "a Financial Times analysis of last year's tips shows mixed results. An investor who followed every top idea from the 12 speakers last year would've made 19%, less than the 22% gain available from a passive index fund tracking the US stock market." As far as I'm concerned, yes, there are a number of outstanding hedge fund managers who deliver exceptional performance year in and year out, and if you are fortunate enough to find one, I suggest you hand them all your investable funds. In general though, Gertrude Stein may as well have been speaking about hedge funds when she said "There is no there there." By way of reference, Peattie Capital's recommended stock last May was KVH Industries, ("KVHI") which has subsequently gained 49%. March 28, 2013 What do you need to do to outperform as an active stockpicker? The best answer to this question that I've seen is from David Swensen, CIO of Yale's Endowment, considered to be one of the best managers of this era. According to him, managers need to know the overall environment, to run concentrated portfolios, to do extensive research on investments so you know when a sell off is a buying opportunity, to have patience, and to be willing to deviate from an index. March 11, 2013 Warren Buffett's annual letter Not that I agree with everything Warren Buffett says, but I pay attention when he speaks. As usual, his newest annual letter has a variety of investing tidbits and humor. For example, on page 5 he says "Mae West had it right: "Too much of a good thing can be wonderful." More importantly is his chiding of CEOs for hesitating to make capital allocation decisions last year, blaming "uncertainty" which begins a couple paragraphs later. "Of course, the immediate future is uncertain; America has faced the unknown since 1776. It's just that sometimes people focus on the myriad of uncertainties that always exist while at other times they ignore them (usually because the recent past has been uneventful). Pages 5-6 are particularly good reading for anyone who has a long-term investment horizon. Buffett concludes: "Since the game is so favorable, Charlie and I think it is a terrible mistake to try to dance in and out of it..." and states flatly "the risks of being out of the game are huge compared to the risks of being in it." Here is a link to the letter:

March 5, 2013

There was an interesting article in yesterday's WSJ, page R1, titled "Say Goodbye to the 4% Rule" which discusses the challenges facing retirees in such a low return and volatile investment landscape. What had been a good rule of thumb, withdrawing 4% of your retirement account annually (with adjustments for inflation) would generate 30 years of living expenses given historical returns of stocks and bonds, has been somewhat nullified by returns over the past decade. For example, using that approach and starting on Jan. 1, 2000, (with a 55% stock and 45% bond portfolio) your portfolio would've fallen by a third after 10 years, significantly reducing the potential lifespan of the account. As far as I'm concerned,. timing is critical, and blindly following financial models is dangerous to your financial well being. September 9, 2011 One of Peattie Capital's core beliefs is that stock price movements have become increasingly correlated, especially so in down markets. This is problematic for anyone trying to hedge, and frustrating for fundamental stock pickers. After all, what's the point of doing deep research on a company if its share price is going to trade in line with the market? Eventually, fundamentals will take over, and owning the right names will be rewarded. But, who knows when "eventually" is. Here's a link to a feature article in today's FT discussing today's extraordinarily high correlations, "Correlation of US stocks highest since 1987 crash." Read it here

July 13, 2011 This article supports one of Peattie Capital Management's core tenets, that intelligent, wealthy investors are dissatisfied with the quality of advice and performance they receive and are "typically paying between 2-3%" of assets under management for that mediocrity. Why would anyone do that? Read it here

June 9, 2011 I thought this piece by James Mackintosh in today's FT was worth the two minutes to watch. Broadly speaking, hedge funds have failed miserably in their stated goal of making money in any market environment, up, down or sideways. And despite their mediocre performance, assets under management have recently been growing again. Lately I have read that they continually point out that they did a good job in 2008, when they only lost, on average, ~20%, roughly half the market's loss. To me this is more slick marketing....what happened to absolute returns? And in many cases, when clients asked for their money to be returned, they learned that there were "gates" and that they couldn't have it. Peattie Capital continually tells clients and prospects that if I lose 20% of your money AND tell you I've done a good job, then you should fire me on the spot, and take back all your money. (Which, by the way, is easy to do because there are no lockups.) As far as I'm concerned if that were to happen then either a) I didn't know what was going on or b) I am trying to camouflage the issue by switching the comparison to a relative value framework, or c) both. For sure, if you can get into one of the hedge funds that really do what they say they can do, and have a record of doing so, then I recommend you give them a healthy slice of your investable assets and gladly pay the hefty fees. In those very rare cases (1% of all hedge funds?), it is worthwhile.

May 27, 2011 One of my favorite investments for the past few years has been energy-related Master Limited Partnerships ("MLPs"). Typically these companies are involved in the storage, transportation and distribution of oil and natural gas and other oil by-products. In addition to exceptionally attractive yields, ranging roughly from 6-9%, a significant portion, usually 80-90%, of the dividends paid are considered a "return of capital." As such, unit holders are only taxed on 10-20% of the dividend received. The remainder of the dividend is used to reduce the original cost basis. MLPs have had corrected roughly 10% in May, partly due to the drop in oil prices, but more importantly because of talk in Washington that the tax-status of the dividend may be changed. As far as I'm concerned, both these conditions are temporary, and MLPs, broadly speaking, represent good value at these levels. A May 26 NY Times article states the same thing, although it neglects the potential change in tax status as a reason for the recent weakness. (click to view) May 12, 2011 Can the equity markets be manipulated? Since the end of March, there have been 28 trading sessions. 25 of them have closed "uneventfully", that is with a less than 1% move in the S&P 500. The other three were May 11, April 20, and April 18. In these three instances, the S&P 500 did move more than 1%, twice to the downside and once to the upside. What is peculiar to me is that these days were all "one-direction" days. That is, in the up session there was no overcoming of early weakness, but rather an up opening after a strong overnight futures session and a session which never traded in the red. Likewise the down days were down opens, and never saw the black. Going back to August, 2010, when Bernanke announced QE2, this same pattern has existed. According to Jerry Hagerty (Morning Newsletter, May 12 , 2011) "Since QE2 began at the end of August, there hasn't been one single trading day in which the S&P futures gained 1% after being down at any point during the day. Amazingly, every +1% (or more) up day was propped higher via an up open and never saw a negative print during the day." What does it all mean? Who knows, but it strikes me as odd.

April 25, 2011 Some great data from David Rosenberg's "Breakfast with Dave" morning research piece today putting gold prices in perspective: Rosenberg is the Chief Economist and Strategist at Gluskin, Sheff in Toronto.

April 11, 2011 Matt Taibbi, the writer from Rolling Stone who called Goldman, Sachs a giant squid, recently authored another interesting article about the financial industry, this one title "Why Isn't Wall St. in Jail?" Here's a link: http://www.rollingstone.com/politics/news/why-isnt-wall-street-in-jail-20110216?page=6

April 4, 2011 In contrast, Peattie Capital is committed to A) always acting in the client's best interest B) creating customized, independent solutions aimed at addressing specific client circumstances and C) being as simple, transparent and "user-friendly" as possible. Take a look at these three for more detail: "Industry 'overpaid' by $1.300 billion" by Steve Johnson http://www.ft.com/cms/s/0/3adcb3e6-5c9c-11e0-ab7c-00144feab49a.html#axzz1IYysBnIy "Funds rally to stem the march of the middlemen" by Steve Johnson http://www.ft.com/cms/s/0/a74c42d0-5c9c-11e0-ab7c-00144feab49a.html#axzz1IYysBnIy "Financial models useful but limited" by Rodney Sullivan http://www.ft.com/cms/s/0/b78d47d4-5c9c-11e0-ab7c-00144feab49a.html#axzz1IYysBnIy March 30, 2011 March 16. 2011 March 15. 2011 From an investment perspective, I have been concerned about the markets's behavior since the beginning of the month. For starters, the "first of the month" inflow trade didn't work. That is, during this leg up since August, the first day of each month has performed well, probably due to allocators moving money into equities and away from bonds. I noticed that in the Wall St. Journal that day Dennis Gartman was quoted about this pattern. And I was told that Bob Pisani was discussing it on CNBC. (I don't have a TV in the office and don't follow CNBC). As far as I'm concerned, if a trading pattern is being discussed on television or in the newspapers, it is finished. As soon as the opportunity becomes known, it goes away. Additionally, the daily put/call ratio is just now (March 15) getting above 1.0. I would've expected to see this happen sooner, as several days this month have been volatile. Yet, investors seem to be taking this volatility in stride, and haven't been accumulating puts. My takeaway is that there is still too much optimism, and I would expect further weakness until we have several days of a put/call ratio above 1.05. February 14, 2011 January 9, 2011

Stated differently by Peter Bernstein (ibid), author of "Against the gods: the remarkable story of risk," who said "Our lives teem with numbers, but we sometimes forget that numbers are only tools." Peattie Capital couldn't agree more, and reiterates it's core belief that a broadly diversified portfolio of equity securities won't protect investors wealth during times of volatility. If you think you have protected yourself from significant loss of principle as a result of such a portfolio, you are mistaken.

December 25, 2010

12/9/10

11/29/10 One of Peattie Capital's core beliefs is that so-called market truisms are either misunderstood or mis-applied. For example, the notion of diversification, as practiced and sold by the major investment banks and asset managers, isn't effective in protecting wealth in a down market. Assets and asset classes that have been thought to be predictably uncorrelated aren't, and in a down market these supposedly uncorrelated assets act in unison. That is, they all go down together. As I've said many times, if you think you have protected yourself from a down market because you have a broadly diversified equity portfolio, you are mistaken. That is not to say that starting with some split between bonds and equities (traditionally 60/40) isn't a good place to begin, just that within the equity component correlations move towards one in down markets. The result is that when you most need protection, diversification is at its least effective.

11/15-19/10 To me this overwhelming call demand is a sign of too much optimism, and my guess is that any of these recently-purchased calls that expire this month will become worthless. The only beneficiaries will be the sellers of the calls, i.e. the large investment banks. Friday's (Nov. 12) put/call ratio was 1.03, which suggests to me that at least for now, the worst is behind us. After options expiration this Friday, I would guess that the market can continue upwards, but to my way of thinking there is virtually no chance that new highs can be achieved until this options cycle is over.

10/29/10 Prevents anyone but the client from moving funds into or out of an account;

10/21/10

|

| Peattie Capital Management, LLC · 1200 High Ridge Rd. Stamford, CT 06905 · 203-308-1204 |

| © 2010-2025 Peattie Capital Management, LLC Privacy Statement Terms of Use Free Newsletter |

Design + Hosting

Ossining Design Guild

This headline on the

This headline on the